Soft vs. Hard Economic Data: Understanding the difference

As economic conditions evolve in response to shifting trade policy and global developments, interpreting the data becomes increasingly important. At PYGG, we believe that understanding the nature of the information shaping financial decisions is essential. One of the key distinctions we track closely is between soft and hard economic data.

This article outlines the differences between the two, highlights recent trends, and explains what they may imply for the broader economic outlook.

Soft Economic Data: Gauging Sentiment and Expectations

Soft data reflects expectations, sentiment, and intentions, typically gathered through surveys of consumers, executives, and industry professionals. While this data does not measure actual economic activity, it often provides early signals about the direction of future behavior.

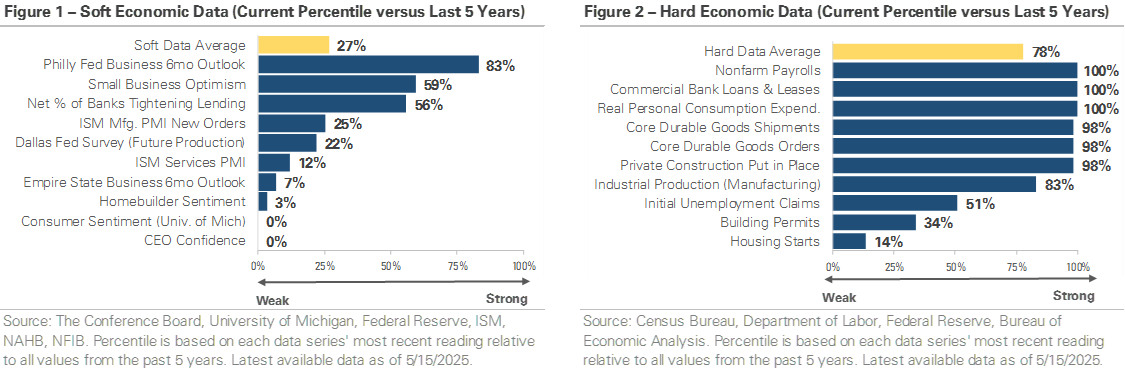

Recent indicators show broad-based weakness in sentiment:

- Consumer sentiment and CEO confidence are both at the lowest levels in five years (0th percentile), highlighting elevated uncertainty.

- In housing, builder sentiment remains subdued amid high mortgage rates and affordability concerns.

- Regional business outlook surveys from the Dallas and New York Federal Reserve banks also indicate caution.

- The Philadelphia Fed survey appears somewhat more optimistic, though it was conducted shortly after the 90-day pause on new tariffs, which may have temporarily lifted sentiment.

A few soft indicators—such as bank lending standards and small business optimism—appear stronger. However, these are rebounding from previous lows experienced during the 2022–2023 period of aggressive interest rate hikes. Overall, soft data currently sits in the 27th percentile relative to the past five years, underscoring a cautious outlook.

Hard Economic Data: Measuring Actual Performance

Hard data, by contrast, tracks real-world outcomes such as production, spending, employment, and investment. It is objective, quantifiable, and forms the foundation for evaluating current economic health.

In contrast to soft data, the latest hard data remains robust:

- Company payrolls, bank lending, and consumer spending all rank in the 100th percentile, indicating strong labor market conditions and resilient consumption.

- Manufacturing activity, including durable goods orders and industrial shipments, remains high, with construction spending also elevated.

- Some moderation is visible: jobless claims have edged up (51st percentile), and housing starts and building permits are down from their pandemic highs—reflecting a cooling in residential development.

On average, hard data ranks in the 78th percentile, suggesting that underlying economic momentum remains intact despite softer sentiment indicators.

Interpreting the Divergence

While soft and hard data usually move in tandem, they can diverge during periods of uncertainty—such as now. This divergence is not uncommon and does not inherently signal an economic downturn. Rather, it reflects a landscape where perceptions of risk may not yet be mirrored in behavioral outcomes.

Soft data can change quickly in response to news or policy developments; it functions like a forecast. Hard data, meanwhile, provides a more grounded view of what is actually happening in the economy today.

Understanding this distinction is crucial when interpreting market conditions and formulating strategy.

A Balanced View for a Changing Landscape

The current divergence between soft and hard economic data reflects a complex and evolving economic environment. While sentiment and expectations have grown more cautious in response to policy shifts and broader uncertainty, the underlying economic indicators—employment, spending, and production—remain strong.

Both types of data offer valuable insights: soft data can signal turning points and shifts in confidence, while hard data confirms whether those shifts are translating into real-world outcomes. Understanding how to interpret these signals in context is essential for making informed financial decisions.

As conditions continue to change, maintaining a clear, balanced view of both sentiment and activity will be key to navigating the path ahead with confidence and clarity.

We remain committed to guiding our clients through complexity with clarity and strategic foresight. If you have any questions about how these trends may affect your financial plan or investment strategy, we invite you to reach out to your PYGG advisor.